richmond property tax payment

General Correspondence 1317 Eugene Heimann Circle Richmond TX 77469-3623. Access City of Virginia Official Website.

Push To Lower Tax Rate In Richmond Moves Forward

Property Tax Vehicle Real Estate Tax.

. Selecting options for consulting taxes. Online Payments Other Services Elections and Voting Weather and Traffic. Therefore the city has increased the amount of automatically applied Personal Property Tax also known as car tax Relief to offset our residents tax burden.

Property Tax Vehicle Real Estate Tax. Governmental Operations Standing Committee Meeting - October 26 2022 at 200 pm. Payments should be mailed to.

The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. Box 4277 Houston TX 77210-4277. City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector.

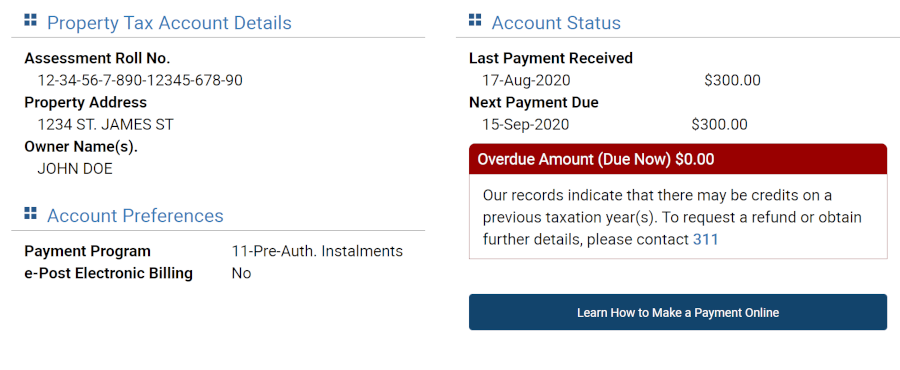

To pay your 2019 or newer property taxes online visit. Billing and payment options please contact the Richmond County Treasurers Office for information regarding your bill or payment options. Master Fee Schedule.

May 23 requesting the due date. The Tax Commissioner is an elected Constitutional Officer. Business License Search Payments.

Pay your taxes online by visiting our Tax. Business License - City of Richmond Instructions for Business License Online Payments httpsetrakitcirichmondcaus Parking Tickets - T2 Systems https. Richmond Hill now accepts credit card payments for property taxes.

Visit our credit card. 2021 property tax bills were due as of November 15 2021. 1 View Download Print and Pay Richmond VA City Property Tax Bills.

Submit Tax Payments PO. Property Taxes Due. Documentary Transfer Tax.

Click here to pay your personal property tax online by August 5. The Tax Commissioner is an elected. Cheque payments are payable to.

With this option the company that processes the payment will collect a 25 service fee. Richmond County Tax Collector. For all who owned property on January 1 even if the property has been sold a tax bill will still be.

Mailing Contact Information. Below are links for online payments for Richmond County services. The City Assessor determines the FMV of over 70000 real property parcels each year.

Other Services Adopt a pet. For property tax payments include the 9-digit Folio Number located the top of the Property Tax Notice.

Richmond Property Tax 2022 Calculator Rates Wowa Ca

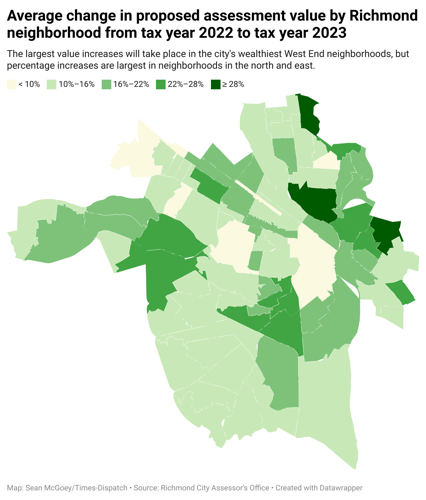

Where Richmond Property Values Went Up Most Axios Richmond

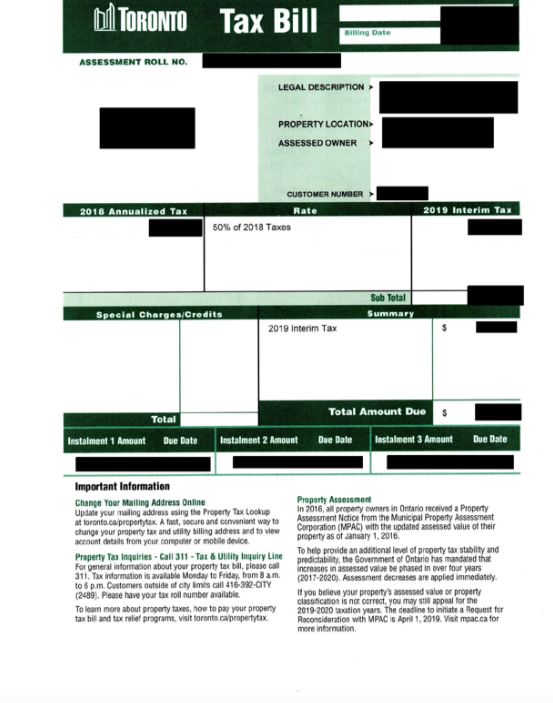

Toronto Property Tax 2022 Calculator Rates Wowa Ca

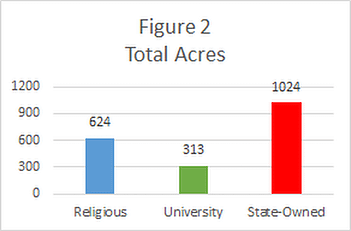

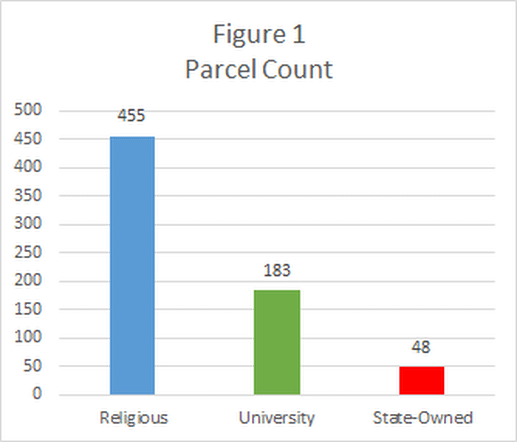

Tax Exemption In Richmond Center For Property Tax Reform

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

Which Document Is It Varity Law Richmond Hill Markham Toronto 905 597 9357

Community Workshop Potential Vacant Property Tax Workshop 3 Richmond Ca Youtube

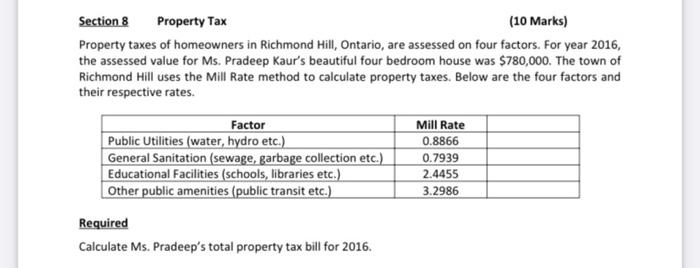

Solved Section 8 Property Tax 10 Marks Property Taxes Of Chegg Com

/https://www.thestar.com/content/dam/thestar/news/queenspark/2017/09/26/401-richmond-getting-property-tax-relief/_401_richmond.jpg)

Arts Culture Hubs To Get Property Tax Relief The Star

Tax Exemption In Richmond Center For Property Tax Reform

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

Richmond Va Cost Of Living 2022 Is Richmond Va Affordable Data Tips Info

Richmond To Vote On Vacant Property Tax

Soaring Property Taxes Renew Calls For Cuts Richmond Free Press Serving The African American Community In Richmond Va

Augusta Metro Area Property Taxes Below U S Average But Richmond County Is Right On The Line

Tax Exemption In Richmond Center For Property Tax Reform

Richmond Hill Council Delivers Second Consecutive Property Tax Freeze